Page 10 - scvhs2018form990

P. 10

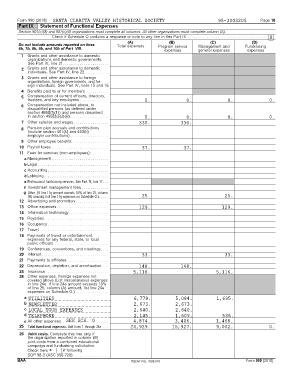

Form 990 (2018) SANTA CLARITA VALLEY HISTORICAL SOCIETY 95-3003205 Page 10

Part IX Statement of Functional Expenses

Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A).

Check if Schedule O contains a response or note to any line in this Part IX. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . X

(A) (B) (C) (D)

Do not include amounts reported on lines Total expenses Program service Management and Fundraising

6b, 7b, 8b, 9b, and 10b of Part VIII.

expenses general expenses expenses

1 Grants and other assistance to domestic

organizations and domestic governments.

See Part IV, line 21. . . . . . . . . . . . . . . . . . . . . . . .

2 Grants and other assistance to domestic

individuals. See Part IV, line 22. . . . . . . . . . . . .

3 Grants and other assistance to foreign

organizations, foreign governments, and for-

eign individuals. See Part IV, lines 15 and 16

4 Benefits paid to or for members. . . . . . . . . . . . .

5 Compensation of current officers, directors,

trustees, and key employees. . . . . . . . . . . . . . . . 0. 0. 0. 0.

6 Compensation not included above, to

disqualified persons (as defined under

section 4958(f)(1)) and persons described

in section 4958(c)(3)(B) . . . . . . . . . . . . . . . . . . . . 0. 0. 0. 0.

7 Other salaries and wages. . . . . . . . . . . . . . . . . . . 330. 330.

8 Pension plan accruals and contributions

(include section 401(k) and 403(b)

employer contributions) . . . . . . . . . . . . . . . . . . . .

9 Other employee benefits . . . . . . . . . . . . . . . . . . .

10 Payroll taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37. 37.

11 Fees for services (non-employees):

a Management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Legal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Accounting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d Lobbying. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e Professional fundraising services. See Part IV, line 17. . .

f Investment management fees. . . . . . . . . . . . . . .

g Other. (If line 11g amount exceeds 10% of line 25, column

(A) amount, list line 11g expenses on Schedule O.). . . . . 25. 25.

12 Advertising and promotion. . . . . . . . . . . . . . . . . .

13 Office expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . 129. 129.

14 Information technology. . . . . . . . . . . . . . . . . . . . .

15 Royalties. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Occupancy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 Travel. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18 Payments of travel or entertainment

expenses for any federal, state, or local

public officials . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19 Conferences, conventions, and meetings. . . .

20 Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33. 33.

21 Payments to affiliates. . . . . . . . . . . . . . . . . . . . . .

22 Depreciation, depletion, and amortization. . . . 148. 148.

23 Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,116. 5,116.

24 Other expenses. Itemize expenses not

covered above (List miscellaneous expenses

in line 24e. If line 24e amount exceeds 10%

of line 25, column (A) amount, list line 24e

expenses on Schedule O.). . . . . . . . . . . . . . . . . .

a UTILITIES 6,779. 5,084. 1,695.

b NEWSLETTER 2,673. 2,673.

c LOCAL TOUR EXPENSES 2,640. 2,640.

d TELEPHONE 2,145. 1,609. 536.

SEE SCH. O

e All other expenses. . . . . . . . . . . . . . . . . . . . . . . . . 4,874. 3,406. 1,468.

25 Total functional expenses. Add lines 1 through 24e. . . . 24,929. 15,927. 9,002. 0.

26 Joint costs. Complete this line only if

the organization reported in column (B)

joint costs from a combined educational

campaign and fundraising solicitation.

Check here G if following

SOP 98-2 (ASC 958-720). . . . . . . . . . . . . . . . . . .

BAA TEEA0110L 08/03/18 Form 990 (2018)