Do Mint Rolls Have Investment Potential?

|

"Making Cents"

The Signal

Saturday, February 18, 2006

| T |

A common thread of questions focuses on the idea of buying uncirculated rolls of coins as they are issued, for long-term investment potential. The track record of most of these purchases has been far less than investment quality. In fact, depending on when you bought such rolls, you probably lost money.

For example, the uncirculated rolls of coins purchased in 1979 to 1981 would probably sell for 20 to 50 percent less today than their original retail price. If such rolls were bought at the bank at face value, most would be worth 20 to 50 percent over their face value. That hardly constitutes a good return for more than 25 years.

On the other hand, had you purchased mint rolls of coins (cents through half dollars) in the 1949 to 1951 period, they would be worth several hundred times their face value today. If you purchased the same rolls in 1980, for example, their market value today would be less than what you paid in 1980.

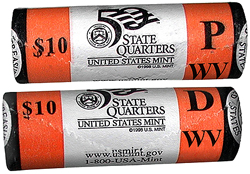

Many people are stashing away rolls of the 50-state quarters from 1999 to date, and plan to finish the series in the next few years. With annual mintages of more than 300 million per state, that would require an enormous buyer frenzy to create any investment potential down the road. Almost all the coins in the series — the "P" and "D" mint coins — can be found in circulation. The "S" mint coins, which come in special sets from the Mint, may have investment potential, but here again, the mintage numbers are quite large and the issue price is also well above face value.

As a boy, I often bought full sheets of new commemorative stamps as they came out — the Pony Express, New York World's Fair, Famous Americans and many others. Today, some 65 years later, if all of these sheets were still in my possession, I'd be lucky to sell them as a lot for 50 percent over face value. That's less than a 1-percent per annum return. The ones I have left, I still use for postage at face value.

Buying coins by the roll started as a collector phase in the early 1960s with local companies such as Manchester Coins advertising the entire series from 1934 of cents through halves in mint condition. Full-page ads appeared weekly in Coin World. Those who bought most of these rolls in the 1960s and still own them have probably earned an annual return of 20 to 50 percent, since the prices were relative low and supply was adequate. Today, 99 percent of these rolls have been broken down into single coins, and those of the highest quality are bringing phenomenal prices, often setting records with each sale.

End advice: Buying currently minted rolls of coins, even at face value, starting now, doesn't look too promising, investment-wise.

Dr. Sol Taylor of Sherman Oaks is president of the Society of Lincoln Cent Collectors and author of The Standard Guide to the Lincoln Cent. Click here for ordering information.

©2006, THE SIGNAL · ALL RIGHTS RESERVED.