Professional 'fixer' transforms a doddering government institution into a vibrant money-making machine

|

November 2007

COINage: Congratulations on your success in turning the Mint around and posting the biggest operating profit in nine years — £8.7 million for fiscal 2006-07 (ending March 31). A year ago you said the Mint was no longer "world class." Is it world-class now?

Barrass: I would certainly say it's world-class now. We've gone back to basics. We've had an in-depth review of everything we do. It's not just on the manufacturing side. It's sales, administration, product development, the whole piece. We've downsized, we've taken a lot of heads out of the work force, but we're actually making better-quality product, faster through-put, with fewer people.

We've got a new corporate identity, which has been very well received; it's also a rallying point for our work force to get behind something that really states what we're about: the quality, the heritage, the craftsmanship, and being proud of what we do.

COINage: By new "identity," do you mean the new logo, or is there more to it?

Barrass: The identity is just the final 10 percent. The work that goes behind that, developing all the brand values and our strategic values as a business, are actually the important parts. It was a program that took us eight or nine months in total, and the corporate ID that people see, the visible part of it, was finalized in the last couple of months. The real work was talking to our customers, talking to our suppliers, finding out what they thought about us.

I've done brand identity work before in other businesses. You get a third party to do the work for you, rather than listen to your own people. Then you get all the horror stories coming back: The product's not right, the service isn't right, this is wrong, that's wrong, you answer the telephone wrong. The feedback we got from this was really special. "We love the product, we love the company, we'd like you to do this a little bit differently." It was really around the fringes that they had criticism.

The message that came across was that they held the Royal Mint with such reverence, with such respect, and I think some of our products they were seeing weren't quite the products that you would think worthy of the Royal Mint. Those products have now all disappeared, and we have very strict criteria — various gates that a product has to go through before we'll release it as a Royal Mint product.

COINage: What products weren't appropriate?

Barrass: The major thing, I think, would be our Classics range that we had. There were a lot of bullion products there, and products I wasn't particularly proud of, and clearly weren't a natural fit with the Royal Mint.

COINage: Classics?

Barrass: There were pottery items, collectibles, but certainly not coins, not numismatic. Not what I would consider to be high levels of craftsmanship or heritage. We're probably one of the oldest manufacturing businesses in the world — we're 1,190 years old, continuous manufacturing. We shouldn't really be diluting that product range with stuff that isn't worthy.

COINage: How long had that been going on?

Barrass: They really started building up in the last four to five years. I think they just went off track, and we've now brought it clearly back on track and [it] is a much healthier place.

|

Barrass: That's right. Twenty months.

COINage: You were going to stay only six to eight months.

Barrass: My contract said five to seven.

COINage: You told Parliament last November, "I'm employed on a very short-term basis, possibly here today, gone tomorrow." Why are you still here?

Barrass: An exact quote. Yeah, why am I still here? We're hopefully nearing the end of the second or third process of trying to find a suitable replacement for me. If the first time we had thrown up the right candidate, it maybe would have been eight or nine months. I made a commitment to the minister in early 2007 that I would stay until they found the right guy.

The current process [of finding a permanent replacement] looks as if it may be successful this time around. We're getting near the end of that process. I said last year [in Denver], this was my last ANA [convention]. I'm saying it again this year. Everyone says, "Yeah, but you said that last year and you came back." I'm serious this time, guys.

COINage: What are you looking for — someone with experience in coining operations, or general manufacturing?

Barrass: I'm often asked what makes the job attractive. If you were [looking for] a high-class manufacturing industry in the Welsh valleys, that could be a reason for joining. If you said it could be working in government, with all the corridor-of-power stuff that goes on, that could be a good reason for joining the business. Working with the palace and protecting the heritage and 1,100 years of history? That's probably a good reason. Working with a world-class brand? That could be a good reason. This job has all of those — and all the issues and complications that go with it.

COINage: Those first couple of those "reasons" could be seen as negatives.

Barrass: Yes, absolutely. I'm sure to some candidates, they would be. But you're looking for a candidate who maybe isn't a numismatic guy. I wasn't a numismatic guy when I joined. But assume you can tick [American: check] all the other boxes. You could take a generalist, because what we have at the Royal Mint is a great team of people who really know the business, who really know coins and numismatics, who really know how the whole system works, who have a pride in what they do. With that team, you could put a very good manager in, as long as he ticked all the other boxes in terms of brand management, handling the government's issues with Parliament, handling the palace issues and those sorts of things.

COINage: You hired an outside consulting firm, Knox D'Arcy, to help with the turnaround. What, if anything, did they know about coins?

Barrass: The answer is they knew nothing, and they've withdrawn from the site now and they still know nothing, because they don't need to. That's not why we brought them in.

As a professional interim manager, normally I wouldn't expect to bring a company like Knox D'Arcy into the business. Normally I would manage that part of it myself. But then, normally, I would work on behalf of a private venture house or an equity capital house or a bank or something where I could make some very harsh decisions on the basis that a business had gone wrong, and it's really "kill or cure" very quickly. You go in and you can be quite vicious about it.

The Royal Mint is a different business altogether. Although the business needed turning around, no one could afford to take the risk of losing it. It had to be there, whatever happened. So we had to take a much more measured approach. We had to make sure we lost none of the 1,100 years of heritage while we were bringing it back to life.

The other thing I wanted to do — we were working in the Welsh valleys. We've got a very proud work force. A lot of those guys had been there a long time. ... The Mint was originally taken down to Wales from London around 1970 to offset the closure of the coal mines, which were the major employer in the valleys at the time. If we had to force people out of the business, there would have been social consequences. ... If there was going to be any change that was going to affect the level of the work force that we had there, which it did, I wanted to make sure we did it in a constructive way. We actually had the unions working alongside us. By the time we finished the exercise, we lost no one except volunteers [workers who voluntarily accepted severance packages], and people who volunteered for early retirement. There was no one forced out on the street.

COINage: You eliminated 72 full-time employees, and how many casuals? (American: temps and/or part-timers.)

Barrass: It depends where you set the baseline. At the peak last year, we had 960 people. We're now down to 752. That peak included quite a lot of seasonal work. I think the real number is probably nearer [to] 920 on a stable basis. So we've taken [out] about 170 people, of which 72 were full-time.

|

Barrass: We've made a lot of purchasing savings. I don't think we were buying services and goods particularly effectively, and we've had some huge benefits there. But I think it's more. The real thing is the people. We've brought about the beginnings of a real cultural change at the Mint. We've got a great management team now, a mixture of old hands with lots of experience and young guys who've come up through the Mint, and we've opened their eyes to actually running it as their business rather than as a Treasury department.

We're still a Treasury department, nothing has changed there, but it's more the attitude of mind. If you're civil service, a government employee, what do you do when you get up in the morning? What excites you? Where you think the parameters are is much different if you get up and you think: I'm working in a vibrant business and I'm excited about the business and we're going to push the boundaries back a little bit more today. That's what we have achieved in the 20 months.

COINage: Explain what it means to be a "trading fund."

Barrass: The trading fund is a particular sort of government department. It means we can make money. ... The next step [toward] getting even more autonomy would be what we in shorthand call a GovCo, which is a wholly owned subsidiary of the government.

COINage: What advantages would that give the Mint?

Barrass: It basically sets us up as a genuine legal limited company. If we wanted to get in partnership with someone, or if we wanted to make an acquisition, or we wanted to do some other deal on a commercial basis, it's just much more simple. If you're the other party, you're doing a deal with a limited company. At the moment, effectively you'd be doing a deal with the government. That has all sorts of drawbacks.

COINage: But right now you are competitive with private coin-making companies—

Barrass: We certainly are.

COINage: Who are your biggest competitors in world coin manufacturing?

Barrass: There are some major mints who are upstairs [on the bourse floor of the ANA convention], and we have good relations with those guys—

COINage: Private mints? Government? Both?

Barrass: Both. We also see as competitors some of the distribution companies who aren't mints in themselves. Because in addition to being a mint, we are also a huge direct-marketing operation in the UK. There are companies that we see as competitors because they're doing what we do, but we also see them as customers because they're doing what we do with some of our product, as well. That's quite an interesting relationship.

COINage: Why was there a 12 percent increase in demand for circulating UK coinage in 2006-07, after the demand had leveled off in recent years?

Barrass: If I had the answer to that, I'd have the keys to the door. It's a very strange thing. I know some of the factors, but one of the [challenges] all of the mints have, including the U.S. Mint, is forecasting consumer demand of circulating currency.

At the moment in the UK, we are having a very strange summer. It's the wettest summer we've had, like, forever. Right now, there is reduced demand for coinage. Why is that? Well, it's because people aren't getting out and they're not buying the small-ticket stuff. They're not buying the ice creams or going to theme parks. Half of them are flooded anyway. It is having an impact.

Last year, one of the major supermarket chains in the UK changed the emphasis on the coins they carry in the till. Where previously they'd been reluctant to stock £2 coins — if you spent £1with a £5 note you'd get four £1 coins in the change — they changed that overnight. So now, all of a sudden, we've got the wrong balance of coins out.

There doesn't appear to be an easy science to it, and if anyone anywhere in the world could get into a really good forecasting model, all of the national mints would be looking to buy into it. We all struggle with the same problem.

COINage: How are metals prices impacting you?

Barrass: In terms of the circulating coin, we effectively pass the metal price straight through to the customer. ... If you look at the main metals we use — copper and nickel and zinc, for homogenous coin [alloys that are neither plated nor clad, as with the U.S. 5-cent piece] — the way the market prices have gone in the last year, that's a huge increase in the cost of that coin. On our low-denomination coins, the 1p and the 2p, we made the move away from homogenous coins in 1992. Since 1992, they've been copper-plated steel coins. It doesn't surprise me that your penny actually has a lower face value than the amount of metal that's in it.

COINage: Is there any coin you have that's approaching face value?

Barrass: Not that we currently manufacture. But we didn't go through a recall operation of those pre-1992 1p's and 2p's, so they're still out there. There will come a point where it is worth us recalling them and melting them down.

COINage: You will recall them?

Barrass: We could do [that]. We have the option to recall them if the copper price, in this case, got so high. But one of the strange things in metal prices this year is they haven't just been going in one direction. They go up and then they slump a little bit. We would need it to be considerably higher before we'd want to take the risk of recalling them. Sod's law [American: Murphy's Law] says the month you recall them, the copper price goes through the floor and you've just bought a lot of unnecessary metal volume.

COINage: Your profits were up 78 percent this year for circulating coinage (£7.3 million). How did you do that?

Barrass: We've got a different set of constraints on our sales force. We've got a lot of fixed assets at the Mint to support the UK coinage, and the old mentality was to keep those assets busy at any price. We would take [foreign coin production] business at the best price we could get it to keep the plant full.

We've changed that. We only look for profitable business now. I would rather run the Mint with occasional quiet periods, knowing that everything that goes through is going to make money, rather than take marginal business and then more marginal business and then suddenly wake up one day and smell the coffee and [realize that] everything I'm making today I'm losing money on. How smart can that be?

COINage: You posted 129 percent higher profits on the collector coin side (£9.7 million). That can't be just from eliminating the frou-frou stuff that you didn't want to make any more, can it?

Barrass: No. But that had a major impact. When we looked at it, not only was some of the product range inappropriate; it wasn't particularly profitable, either. Moving out of that, on the one hand, and concentrating on marketing what we do well and what we're famous for, on the other hand, has really made a huge difference of our business.

[Also], we had done a lot of marketing and investment in the previous years on our direct marketing operation. We could cut back on that promotional work ... but still benefit from the work we'd done the year before. That's basically a timing issue.

The year you're referring to wasn't a one-hit wonder. We're building on that now, and as long as that team stays in place, it doesn't matter who the general manager is who comes in. We've got a platform now that we can move forward.

COINage: In 2008 you're redesigning your circulating coinage for the first time in 40 years. What sort of public input was there?

Barrass: It was a totally open public competition for submissions. We had over 4,000 submissions — 4,000 ranges, because each submission had to have each of the denominations: 1p, 2p, 5p, 10p, 20p and 50p. Six coins in a set. We had over 4,000 submissions, which gave us a little bit of a problem.

Normally when we do our circulating coin, with one coin, say a new £2 design or a new 50p design, we may [invite submissions from] six to eight artists. To suddenly find that you have over 4,000 submissions, times six coins — and you have to treat each one with care and respect because, for whoever submitted it, this is what he wants you to buy off on.

The Royal Mint Advisory Committee — I'm just not a committee guy at all, [but] this committee really cooks on gas. I have loads of respect for them. They got that down to about six submissions by the time I arrived. Then, through 2006 and the early part of 2007, we got that down first to two, and now we've got it down to the winning collection.

COINage: Wasn't the public involved in the selection process?

Barrass: No. That would have been a logistical nightmare. I'm not saying I wouldn't have wanted the input, but — no. You just couldn't have gone there. The other thing: The public might well have gone for a particular design that we knew, on a three-dimensional coin, just wouldn't work...

It's surprising how many good, established artists — not numismatic artists, but good, established artists in different fields — cannot come up with a good coin design. You're trying to get your whole heart onto something that's only that big, where you've only got an impression depth of whatever it is, and depending on whether it's a collector coin or a circulating coin, you've either got to make them at 30 an hour or 850 a minute. It's a very skilled task. The public would not be in a position to judge that.

COINage: Is the fact that you're redesigning the coins next year a signal that the UK will never adopt the euro?

Barrass: That's not a question for the Mint. That's a question for politics. I can tell you as a layman with no inside information at all, there is not a lot of public debate about the euro. The whole appetite for the conversation seems to have quieted down. But if someone came up tomorrow and said we've made the decision to go euro, there would still need to be a design process to design the reverses. I think it's pretty established what we would have on the obverse [the queen]. But we'd have to go through that whole process, and that would take a length of time. We'll get plenty of mileage out of this even if someone did choose to go there...

We will be bringing these new reverses out in the spring of 2008. I think they're fabulous. I think they're innovative.

COINage: Who won the design contest?

Barrass: The winner is someone who has, to date, not been associated with coinage. It's a really romantic story in that we've gone out to the public, we've asked for submissions ... and we do everything anonymously. The secretary to the [Royal Mint Advisory] Committee knows the names and whether it's A, B, C, D or E. The committee [members], including myself, have no idea who submitted this particular design. We go purely on the design merits. We're not influenced by whether this guy has done 10 coins for us already and we like him or her, or whether it's a new boy on the block.

|

Barrass: That will come out with the announcement of the reverses.

COINage: Is he British subject?

Barrass: A British subject.

COINage: So it's one artist for all the coins?

Barrass: Yes. It's a series of coins.

COINage: They all play together?

Barrass: They do.

COINage: Are they all heraldic? What's the basic theme?

Barrass: [Silence.]

COINage: Will you be doing redesigns more regularly now?

Barrass: No. One thing I committed to last year at the ANA was not to increase the number of issues a year. If anything, reduce the issue limits on coins that we issue.

I've got a firm belief that we're dealing with future history here in our coinage. I've become totally distraught at some mints, [which] seem to be producing these things like confetti. In 100 years' time, people are going to pick up coins from their mints and have no idea what that was about. I'd like to think that in 50 years or 100 years or 500 years' time, people will pick up [our coins] and say, "Ah, 2007. Wow. I've not seen one of those before."

If you go up to the third floor [at the convention] and look what's behind the mint stands, there is table after table of collectors and what we refer to as the secondary market. Those guys are there, doing a great job, and they love it to death, but they're doing it because we've made the coins properly in the past. We haven't gone for a proliferation of, you know, 53 new issues every year and overbuilding the issues.

COINage: You're not up there selling porcelain thimbles.

Barrass: Absolutely right. Well done.

COINage: To what degree have you been able to influence the coin designs that have come out in 2007?

Barrass: To a high degree.

COINage: What are you most proud of this year?

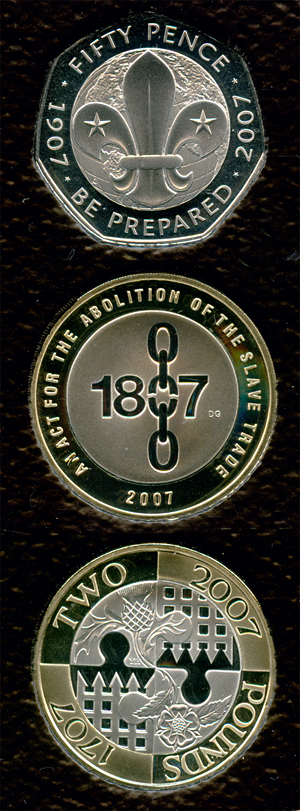

Barrass: I think the Scouting coin is a great coin, and I still love the rose window from Westminster Abbey. We've had coins that have sold out. We've had five sellouts already, which [reflects] my last year's commitment to sensible issue limits. Once we've said that's the issue limit, that's it. We had one coin that sold out on the first day. You could accuse me of maybe getting that one wrong, but it was a special coin: It was the Act of Union gold [£2], and that went straight away. There have been coins that have created more of a sensation in different ways. The Abolition of Slavery [£2] obviously was a very emotive subject [and] the coin has been very well received...

COINage: Who comes up with the ideas for the coins, and who makes the decision to produce them?

Barrass: The ideas tend to be generated within the Mint. We'd come up with a selection of themes for the following year but one [i.e., the year after next]; we're currently working on the 2009 themes. We'll put those forward to the Treasury with our recommendations. We will then go over to the Royal Mint Advisory Committee and we'll brief artists, in line with the way the themes have been agreed with the Treasury, and then the Royal Mint Advisory Committee takes it from there and it goes full circle back to the Treasury for approval of the actual coin, and then it goes to Her Majesty for her approval.

COINage: She makes the final decision.

Barrass: Yes.

COINage: In 2008 you'll have a crown for Prince Charles' 60th birthday, a crown for the 450th anniversary of the accession of Elizabeth I, and a 2-crown piece to commemorate the 100th anniversary of the 1908 London Olympics. Whose idea was it to commemorate Prince Charles' birthday?

Barrass: Well, he's first in line to the throne, which makes him a big player in terms of heritage, what he'll be inheriting, assuming it goes that way. There are various [historical] milestones that we go through, and when we have them all laid out in front of us, it's a matter of which ones you actually go for—

COINage: It didn't have anything to do with the popularity of the various Princess Diana coins?

Barrass: No, that certainly wasn't why it came up. No, we recognize him as himself, and we've just gone through the 60th wedding anniversary [of Queen Elizabeth II and Prince Philip]; it seems appropriate to roll that forward and have the 60th birthday to the heir to the throne.

COINage: How many pounds are you willing to bet that you won't be at the 2008 ANA convention?

Barrass: A lot.

COINage: What has been most fun about your time at the Royal Mint?

Barrass: I love seeing people do things they didn't think they could do and enjoy it. Giving the mint a character outside being a Treasury department. We actually have disagreements with the Treasury now. You're not supposed to disagree if you're part of the team. Hey, we're the Royal Mint. If we don't like what you're doing, we'll tell you.

COINage: Downsides?

Barrass: Socially, this has been a tough assignment for me. I've really enjoyed it, don't get me wrong. It's the most enjoyable assignment I've had. But if I can describe the geography to you, I live just outside London, and that's 160 miles away from where the Mint is. I've got a partner and we've got an 8-year-old. I leave home at 5:30 on a Monday morning; sometimes I don't get home until 8:30 on a Friday evening. From a social view it's very, very tough.

COINage: Pretending the Mint lets you leave, what do you want to do before you retire?

Barrass: Outside the Mint? I'd like to fix some more businesses. It's what I enjoy. It tends to be burnout; typically it is five to seven months and you work from 6 o'clock in the morning until 9 o'clock at night, and you can do that for six months and then do nothing for three months. I enjoy doing that.

But the work I've done at the Mint is now quite well recognized in Westminster. A couple of months ago I was appointed a non-executive director of one of the Ministry of Defense businesses. I can see that that will probably grow into a portfolio of things where I can get involved and influence.

But there's no substitute from being where the buck stops. Being in pole position in the car park [i.e., the best parking space] not because you're the boss and your name is on it — we don't have names in our car park — but because you're the guy who actually got there first and turned the lights on. For people to know that — all of the people in the valleys live locally and they all know how far away I live. For them to get in on a Monday morning at 7:30 or 8 o'clock and find out that Barrass' car is already in pole position, it's like, "Wow. OK, he's serious about this mission." It sends a huge message to people.

COINage: Was there ever any doubt in your mind that you'd be able to turn it around?

Barrass: No. None at all.

©2007, MILLER MAGAZINES INC./LEON WORDEN. RIGHTS RESERVED.